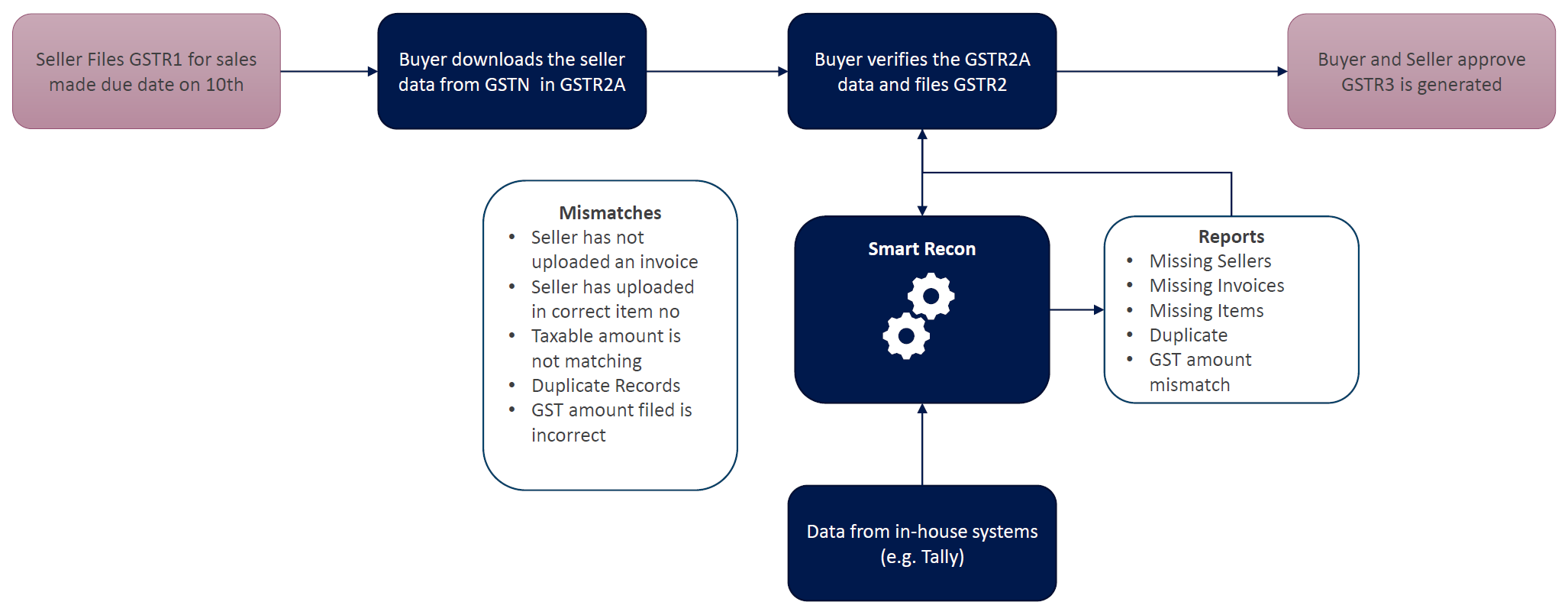

in the overall GST filing process, SmartRecon helps by Reconciling the GSTR-2A data

HOW GSTR-2A Reconciliation Helps

Do Not Loose your input-credit just because of Accounting Errors

Compare GSTR2A Data with Purchase Register and findout the differences in minutes

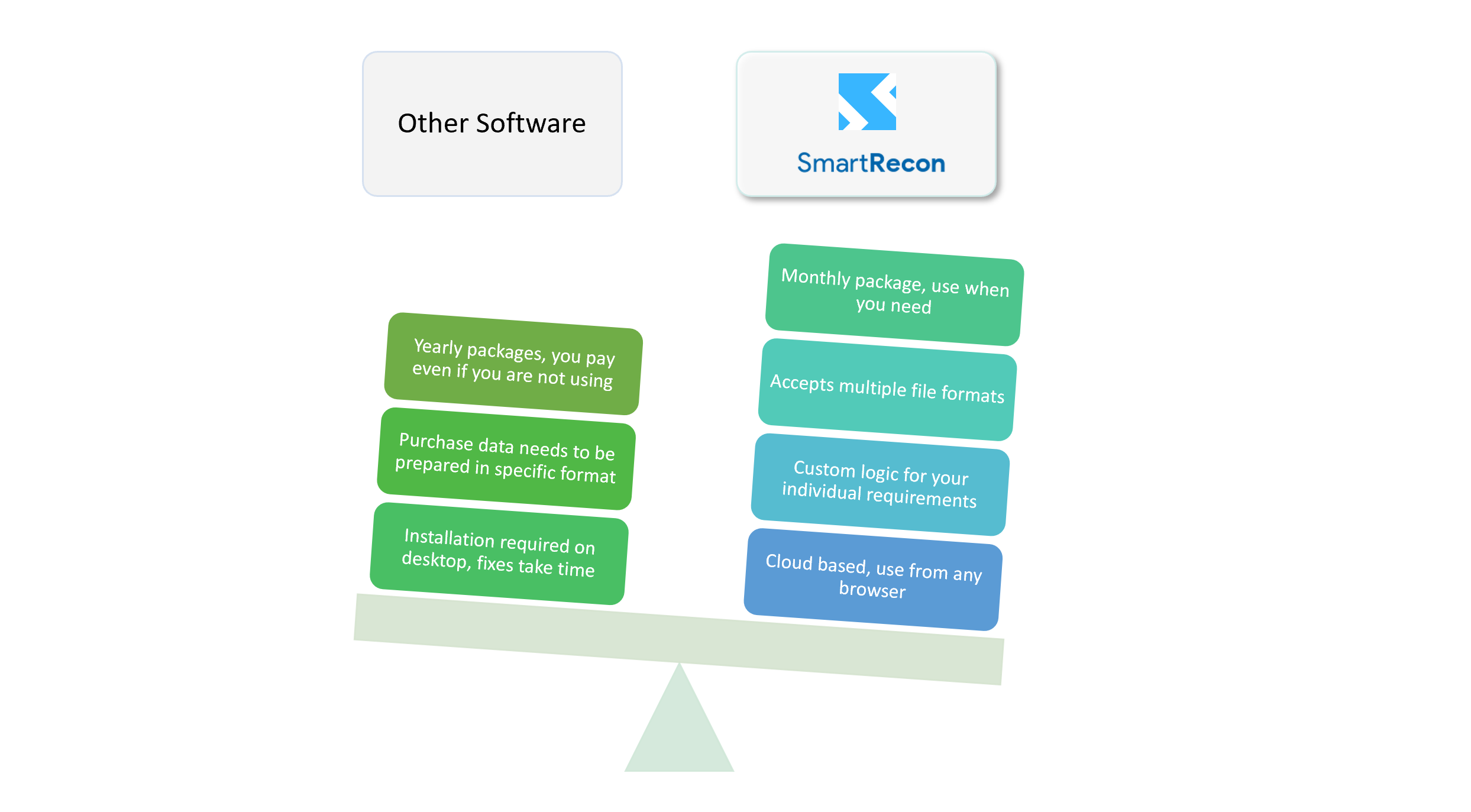

Major Advantages over Other softwares

- We support your Purchase Register data as it is, without any format change

- Help for invoice_number matching even if they donot match exactly

- Log-in as like Gmail, and pay when you use;No installation required and No long term liability.

Invoice Mismatch

- Easily get the Invoice Numbers which are available in the GSTR2A but missing in your purchase register/ERP

- Find invoices which are missing in the GSTR2A

Value Mismatch

- Invoice / Taxable value mismatch

- GST/CESS value mismatch

Supplier Mismatch

- Identify Suppliers who have not filled your invoices on the GST Portal

- Suppliers, those you have missed in your ERP/Purchase register